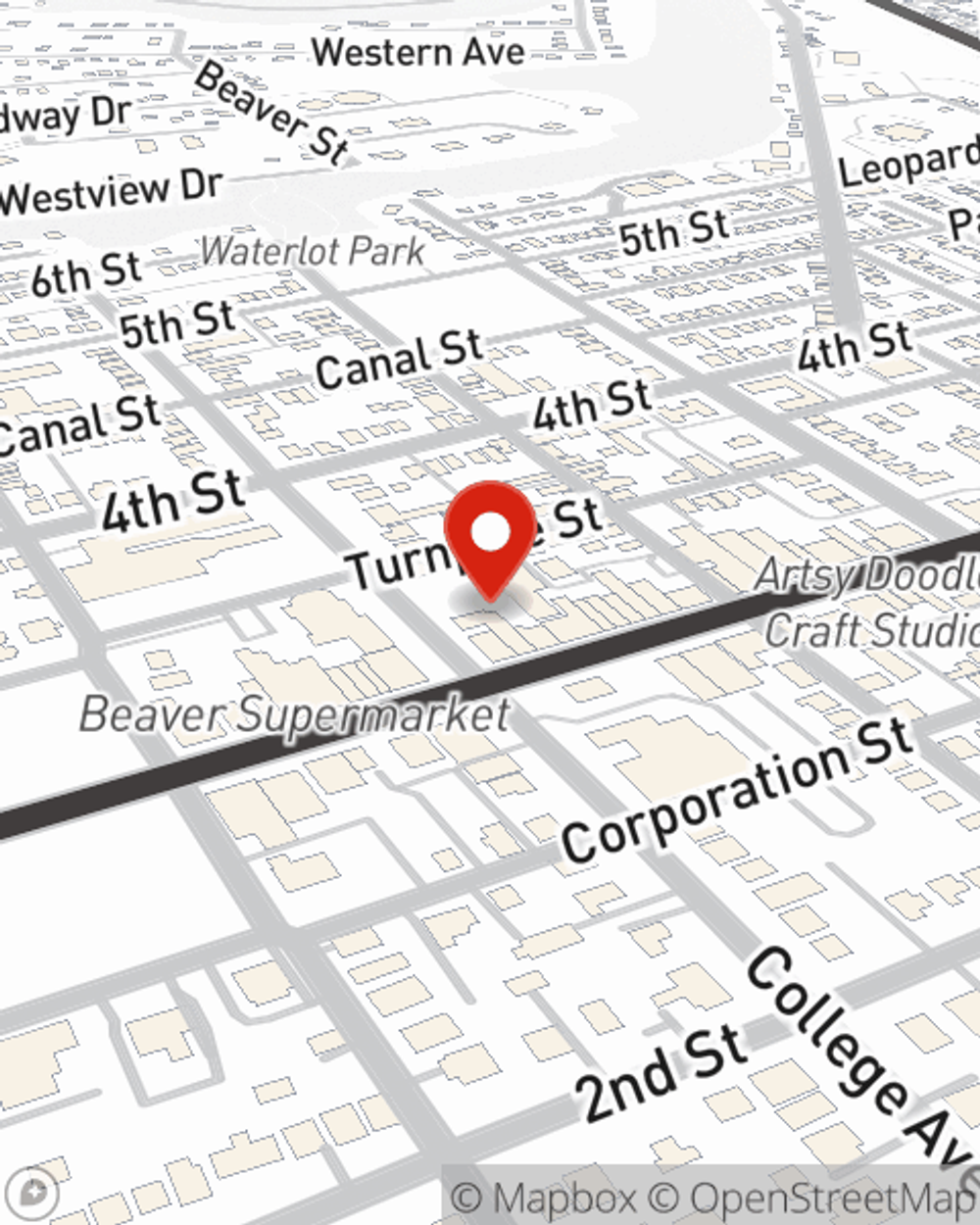

Renters Insurance in and around BEAVER

Welcome, home & apartment renters of BEAVER!

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

Home Is Where Your Heart Is

The place you call home is the cornerstone for everything you treasure. It’s where you build a life with family and friends. Home is truly where your heart is. That’s why, even if you live in a rented townhome or property, you should have renters insurance—even if you think you could afford to replace lost or damaged possessions. It's coverage for the things you do own, like your running shoes and antique collection... even your security blanket. You'll get that with renters insurance from State Farm. Agent Brian Wozniak can roll out the welcome mat with the knowledge and competence to help you determine how much coverage you need. Personalized care and service like this is what sets State Farm apart from the rest. When you're covered by State Farm, your rental can be home sweet home.

Welcome, home & apartment renters of BEAVER!

Renting a home? Insure what you own.

State Farm Has Options For Your Renters Insurance Needs

Many renters don't realize how much money they have tied up in their possessions. Your valuables in your rented home include a wide variety of things like your bed, stereo, bicycle, and more. That's why renters insurance can be such a good idea. But don't worry, State Farm agent Brian Wozniak has the dedication and experience needed to help you evaluate your risks and help you keep your things safe.

Renters of BEAVER, call or email Brian Wozniak's office to explore your personalized options and how you can save with State Farm renters insurance.

Have More Questions About Renters Insurance?

Call Brian at (724) 774-1126 or visit our FAQ page.

Simple Insights®

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Brian Wozniak

State Farm® Insurance AgentSimple Insights®

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.